Did you know that the most important number in your business is not your gross sales or revenue? Nor is it your net profit. The most important number in your business is actually your P&L or income statement.

Why is the P&L or income statement so important? In this post, we’ll explore the answer to that question and show you why this one financial statement should be the focus of your attention as a business owner or manager.

p&l vs income statement

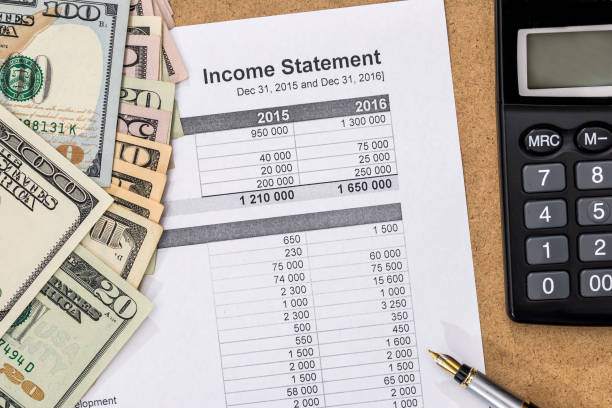

The P&L or income statement is a financial statement that shows a company’s revenues, expenses, and profits over a period of time. The P&L can be prepared on a monthly, quarterly, or annual basis. The income statement is the most important financial statement for a company because it shows whether a company is profitable or not.

The P&L statement is also important because it is the basis for computing a company’s tax liability. The P&L statement can be used to calculate a company’s net income, which is the amount of money that a company has left after paying its taxes. Net income is what a company uses to pay its shareholders dividends and to reinvest in its business.

How to use your company’s P&L to make informed business decisions

Now that we’ve established that the P&L is the most important financial statement for a company, let’s take a look at how you can use this information to make informed business decisions. The first step is to understand the different components of the P&L statement. The three main components of the P&L are revenues, expenses, and profits. Revenues are the money that a company brings in from its sales. Expenses are the costs associated with running the business, such as rent, salaries, and inventory costs. Profits are the difference between revenues and expenses.

Once you understand the different components of the P&L statement, you can use this information to make informed decisions about where to allocate your resources. For example, if you see that your company is not making a profit, you may want to consider cutting expenses or increasing revenues.

The importance of tracking expenses and revenue on a monthly basis

It’s important to track your company’s expenses and revenue on a monthly basis so that you can see how your business is performing.

This information will help you make informed decisions about where to allocate your resources. If you see that your company is not making a profit, you may want to consider cutting expenses or increasing revenues.

Tips for reducing expenses and increasing revenue in your business

There are a few things you can do to reduce expenses and increase revenue in your business:

- Review your expenses regularly and look for ways to cut costs.

- Increase your prices gradually over time.

- Focus on selling higher-priced items that have a higher profit margin.

- Improve your marketing and advertising to attract more customers.

- Find ways to increase efficiency in your business so that you can do more with less.

By following these tips, you can reduce expenses and increase revenue in your business, which will help improve your bottom line.

How to read and understand your company’s financial statements

In order to make informed decisions about your business, it’s important to understand how to read and interpret financial statements. Financial statements can be confusing, but there are a few things you can look for to get a better understanding of what they’re telling you. The first thing you should look at is your company’s revenue. This is the money that your company brings in from sales. You can use this information to track your company’s progress over time and see how your business is performing.

Next, take a look at your company’s expenses. This is the money that your company spends on things like rent, salaries, and inventory. By understanding your company’s expenses, you can make informed decisions about where to allocate your resources. Finally, look at your company’s profits. This is the difference between your company’s revenue and expenses. If your company is not making a profit, you may want to consider cutting costs or increasing revenues.

More Stories

How to Choose the Right ERP Software for Your Company

Essential Advice on Running a Successful Ecommerce Business

Key Elements of a Business Expansion Plan