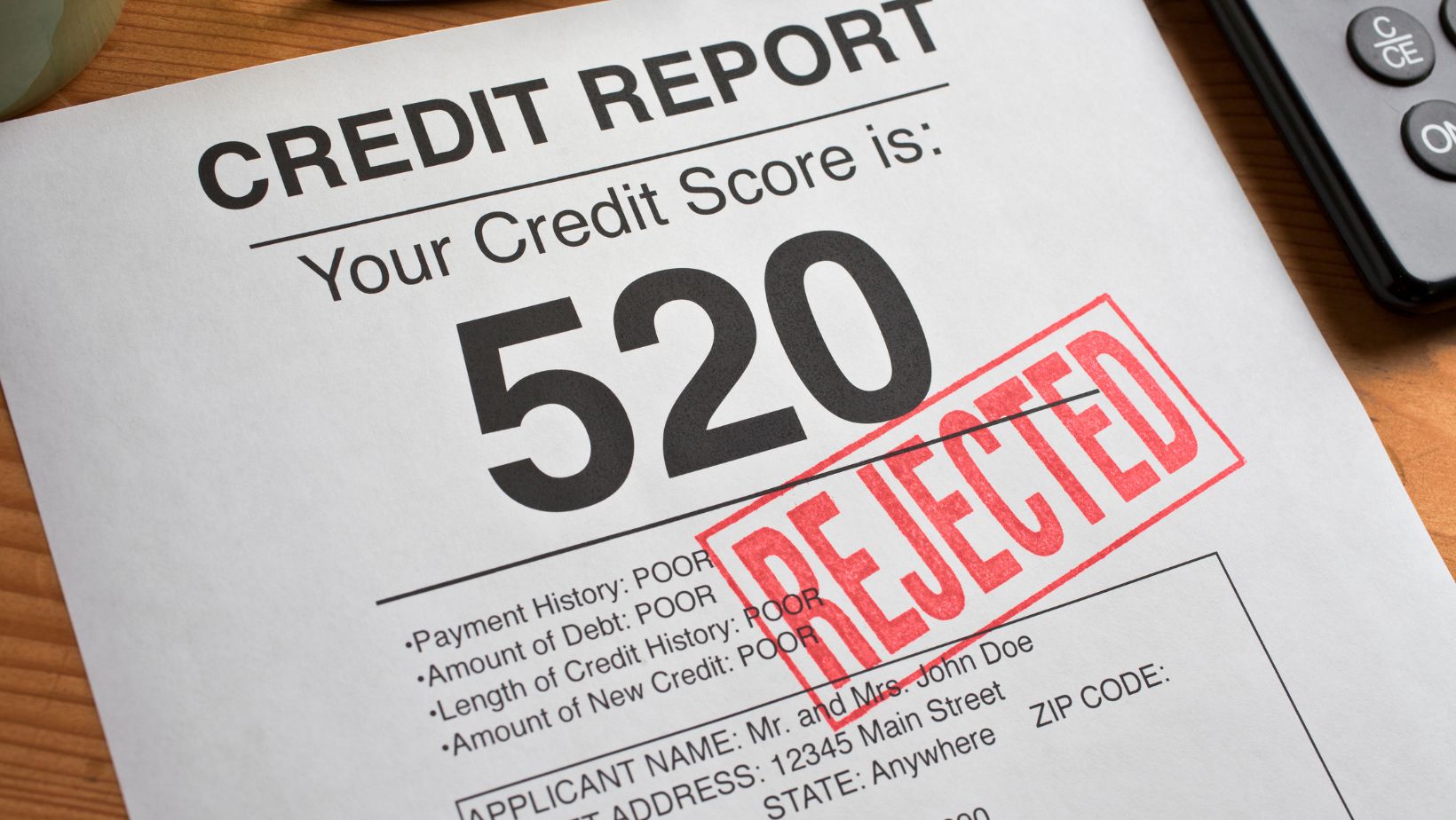

Bad credit can cast a long shadow, limiting your access to loans, apartments, and career opportunities. It might feel overwhelming, but take a deep breath—rebuilding your credit score is an achievable goal. Following a strategic plan can transform your credit from a burden to a powerful tool that unlocks a brighter financial future.

Read on to learn how to repair your credit, establish positive habits, and achieve your financial goals.

Understanding Your Credit Report

Before tackling repairs, you need a complete picture. Obtain a free copy of your credit report from AnnualCreditReport.com. This report details your credit history, including accounts, payment history, and credit utilization ratio (the amount of credit you use compared to your limit). Many consumers find value in Exploring the Effectiveness of Credit Repair Services. But you might be surprised by how many errors you can tackle yourself. Consider reviewing your report thoroughly and filing disputes directly with the credit bureaus for any discrepancies you find

Reducing Your Credit Utilization Ratio

Your credit utilization ratio, expressed as a percentage, reflects the amount of credit you’re using compared to your total credit limit. It’s a crucial factor in your credit score, with a lower ratio generally indicating better creditworthiness.

Here’s how to strategically manage your credit utilization to improve your score:

Prioritize Paying Down Balances

Focus on aggressively paying down existing credit card debt. Even small, regular payments can significantly reduce your overall credit utilization. Consider creating a budget that allocates extra funds towards credit card payments.

Strategize Utilization Across Cards

If you have multiple credit cards, distribute your spending strategically. It’s generally better to spread your charges across several cards rather than maxing out one. This lowers your overall utilization, even if the total amount spent remains unchanged.

Consider A Balance Transfer

If you’re struggling with high-interest credit card debt, explore transferring your balances to a card with a lower interest rate. This can free up more money to pay the principal amount, lowering your utilization ratio faster.

Be Mindful Of Utilization When Using Cards

When using credit cards for everyday purchases, stay conscious of your spending and avoid exceeding a certain percentage of your credit limit on any card. A common recommendation is to keep your utilization below 30%, but even lower is ideal for maximizing your credit score benefit.

Remember, reducing your credit utilization ratio is an ongoing process. By consistently following these strategies, you’ll see a positive impact on your credit score over time.

Building a Positive Credit History

Having a limited credit history or a history of negative marks can make it challenging to qualify for loans or rent an apartment.

The following strategies will help you establish a positive credit history and improve your score over time:

Secured Credit Cards

If you have limited credit history, consider a secured credit card. These require a security deposit that serves as your credit limit. Responsible use can help build your credit score.

Become An Authorized User

If a trusted friend or family member has a solid credit history, they can list you as an authorized user on their credit card. Their positive payment record can improve your credit score.

Consider A Credit-Builder Loan

Some lenders offer credit-builder loans specifically designed to help people build credit. These loans typically require small monthly payments reported to credit bureaus.

Building a positive credit mix demonstrates your ability to responsibly manage different types of credit. While credit cards are a common starting point, consider including an installment loan, like a car loan, in the future to further strengthen your credit profile. Remember, consistency is key.

Staying on Track

It takes time and discipline to maintain your progress and continue improving your credit.

Here are some tips to stay motivated:

Monitor Your Progress

Track your credit score regularly—it’s like watching a seed you planted slowly sprout into a healthy plant. Many free services allow you to monitor your score and see how your responsible financial habits are contributing to its growth. This visual feedback can be a powerful motivator for staying on track.

Celebrate Milestones

Reaching milestones like paying down a credit card or becoming an authorized user is a cause for celebration! Acknowledge your progress and stay motivated.

Practice Healthy Financial Habits

Building good credit is just one piece of the financial puzzle. Develop healthy financial habits like creating a budget, saving regularly, and living within your means. This will set you up for long-term financial success.

You need diligence and perseverance to stay on track with your credit repair efforts. Monitor your progress, celebrate achievements, and practice healthy financial habits to improve your credit and reach your financial goals.

Conclusion

Regaining control of your credit score isn’t a sprint; it’s a marathon. The journey requires dedication and discipline, but the rewards are significant. By following the strategies outlined here, you’ll be well on your way to repairing your credit, building a positive financial history, and unlocking a brighter financial future.

Remember, a strong credit score opens doors to better loan rates, lower insurance premiums, and even dream rentals. Commit to the process, celebrate your milestones, and empower yourself to achieve financial stability and reach your goals.

More Stories

How Smart Budgeting Can Cut Years Off Your Debt Repayment

Are Your Business Decisions Costing You More in Taxes? Here’s What You Need to Know

How to Find The Finest In Test Consumer Loans (I Test Forbrukslån) Companies