Creating a cash flow model in Excel allows business owners to track the business’s overall financial health. If you have access to Google Sheets or even Open Office, you can replicate many of the steps below to create your own cash flow model.

If you’ve never created a cash flow model before, we’ll start with the basics and move on from there. If you want to know how to make a cash flow chart in Excel and how to model cash flow in Excel, this article is for you!

Understanding the Basics

Excel offers the simple, effective features that you need to manage your financials. Tools like Cash Flow Frog can help you better manage your cash flow as your inflows and outflows grow.

Unfortunately, there’s no easy way to view your cash flow in real-time with Excel because you need to input data manually.

Third-party tools often connect to your bank accounts using APIs to gather data and update for you without you needing to go through each inflow or outflow manually. With this in mind, you need to understand the basics of cash flow:

- Cash Flow = Assets – Liabilities

Every cash flow model relies on the following:

- Beginning cash balance

- Cash inflows from investments, operations, and financing

- Cash outflows, which encompass all of your expenses

Cash flow modeling uses the information you have available and creates a model, or forecast, using it.

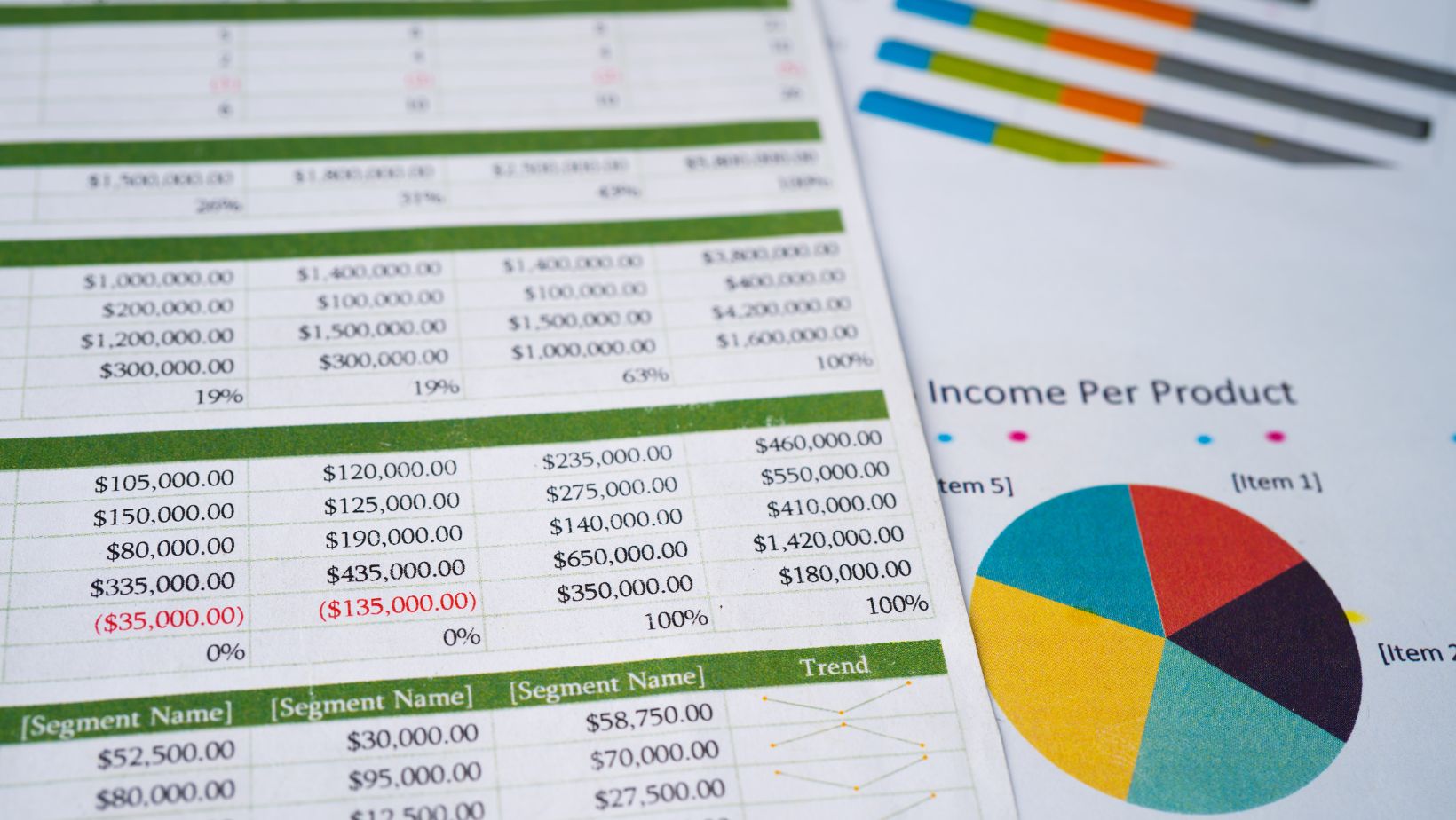

Setting up Your Excel Spreadsheet

A basic cash flow model will include:

- Inflows

- Outflows

- Period of time

- Net

You’ll need to set these up for your operating, financing, and investment activities. For example, you may calculate that you have $100,000 in inflows and $75,000 in outflows during the first quarter, with $25,000 in net cash flow.

Inputting Income Data

Your cash flow model must include all forms of income, including:

- Cash from money received for the sales of goods and services

- Cash from your return on investments

- Cash from financing, such as obtaining a loan

- Cash from the sale of assets

Accountants will go through your books and calculate all of your inflows. You’ll need to go through every account and invoice to verify your cash inflows. One of the tedious tasks is to verify that you don’t have double entries in your income.

Automated tools that connect to your accounts and tally your inflows are the easiest way to run cash flow models.

If you’re running forecasts, you’ll need to determine:

- Historical growth

- Projected growth

Growth percentages must consider things such as seasonal demand, past growth trends, and market conditions.

You can add a projection row on your Excel spreadsheet, such as “10% growth projections,” where you multiply your income by a certain percentage and expenses that aren’t fixed.

Inputting Expense Data

Expenses are any outflows during a specified reporting period. For example, your outflows will include:

- Interest on payments

- Debts

- Liabilities

- Funding

- Operating expenses

Your expenses will include everything from rent to insurance premiums, payroll, utilities, and any other outflows.

Calculating Net Cash Flow

Before you can learn how to make a cash flow chart in Excel, you need to learn how to calculate your net cash flow.

You’ve inputted your income and expense data already. To get your net cash flow, you’ll need to use this data in the following formula:

- Net Cash Flow = Total Cash Inflows – Total Cash Outflows

Simply subtract your outflows from your inflows to get your net cash flow.

Analyzing Your Cash Flow Model

Now that you’ve calculated your net cash flow and created your cash flow chart, the next step is to analyze your cash flow model.

Performing a cash flow analysis will help you understand:

- How changes in different scenarios and variables may impact your cash

- Your business’s future financial health

- Where your cash is coming and going

Analyzing your cash flow model starts with examining your cash flow statement. From here, you can:

- Determine whether there is a net negative or positive cash flow

- Compare the outflows to the inflows

- Draw conclusions and make adjustments as needed

Cash flow analysis can be a time-consuming process, but it’s worth the effort because your analysis will help you understand your business’s financial health.

In Conclusion

Now that you know how to make a cash flow chart in Excel and how to model cash flow in Excel, you can put these newfound skills into practice. Creating forecasts and conducting cash flow analyses regularly will help you stay on top of your business’s financial performance and make adjustments before cash gaps become unmanageable.

This article was written by the Netrocket team, a B2B inbound marketing agency that helps businesses to scale.

More Stories

How Smart Budgeting Can Cut Years Off Your Debt Repayment

Are Your Business Decisions Costing You More in Taxes? Here’s What You Need to Know

How to Find The Finest In Test Consumer Loans (I Test Forbrukslån) Companies